.

By Lawrence Agcaoili, September 25 2018; Philippine Star

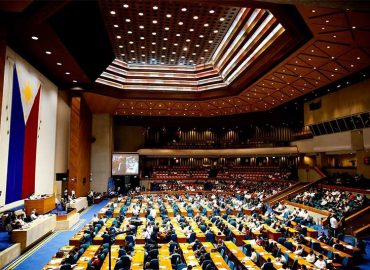

Image Credit to Philippine Star

MANILA, Philippines — The Bangko Sentral ng Pilipinas (BSP) and the Department of Trade and Industry (DTI) are addressing the major stumbling block for micro, small and medium enterprises (MSMEs) in accessing financing.

BSP Governor Nestor Espenilla Jr. said challenges with MSME development still persist, including lack of access to resources such as technology, skilled labor, and information.

“MSMEs are unable to reach their full potential because of difficulty of credit and financial access,” Espenilla said.

“This low level of investment in MSMEs translates to capital constraints compelling MSMEs to resort to internal savings or earnings,” Espenilla said.

He cited a World Bank report that showed only 81.2 percent of Philippine enterprises rely mostly on internal funds to finance their investments, and only 10.1 percent of enterprises use bank financing.

“As a staunch advocate of financial inclusion and of promoting broad-based growth, we at the BSP are very concerned about these numbers. We are committed to providing a regulatory environment to address financial access barriers such as cost, information asymmetry, and lack of infrastructure, among others,” he added.

The MSME sector is a crucial driver of the economy, making up 99.6 percent of the country’s enterprises or registered business firms and generates 61.6 percent of employment.

The BSP and DTI signed a memorandum of agreement with the Microfinance Council of the Philippines Inc. (MCPI), and Alliance of Philippine Partners for Enterprise Development Inc. (APPEND) to make financial services more accessible to MSMEs served by Negosyo Centers across the country.

Numbering over 900 nationwide, Negosyo Centers are one-stop shops that provide assistance such as business registration, business development, advisory services, and market linkages to MSMEs.

In this regard, Negosyo Centers also provide linkage to financial services to their MSME clients. Providing information on suitable financing options, however, has proven challenging for Negosyo Centers due to lack of access to ready information on various financial institutions.

The partnership will institutionalize information sharing and formalize relationships between financial institutions and Negosyo Centers throughout the country.

The MOA also covers the development of a financial education program for MSMEs. The formalized linkage enables financial institutions to better understand the needs of MSMEs and design appropriate products and services.